AIG Malaysia recently marked the countdown to its global 100th year in 2019 and 66th year in Malaysia by covering the four points to look at next year. Antony Lee, CEO of AIG Malaysia identified the areas in road safety, cyber security, protection for SMEs and travellers as the general insurers key focuses.

Understanding Driving Habits

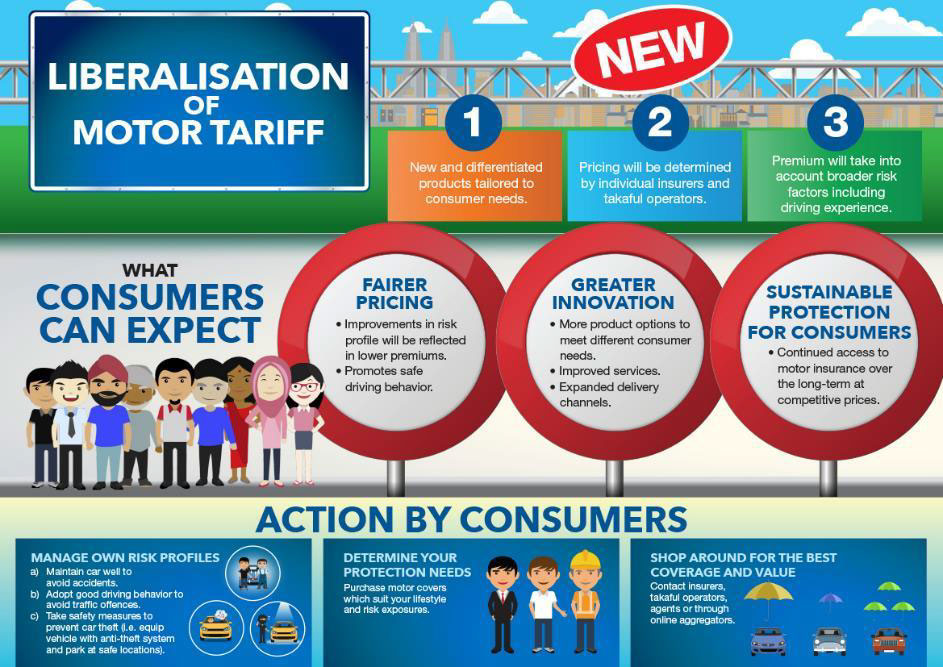

Consumers should be able to see new and differentiated products tailored for their needs, which will be priced according to individual insurers and takaful operators. Premiums will also take into consideration the broader risk factors that include driving experience. How AIG aims to have a deeper understanding on how locals drive is by introducing an intelligent mobile app in 2019 that uses telematics to engage with Malaysians and inculcate safer driving habits via gamification. In fact, road safety should be the number one concern as the Ministry of Transport reported 533,875 road accident cases nationwide and over 6,700 fatalities in 2017.

“Technology has allowed us to locate and manage real-time risks as we improve road safety standards for drivers and pedestrians alike. In line with our #AIGJayaYou promise, we will leverage data-driven insights from our mobile app, along with our claims experience, to cultivate better driving behaviours nationwide. This effort is also in line with the liberalisation of motor insurance where premiums are now heavily influenced by driver risk profiles,” Lee said.

Cyber-Protection

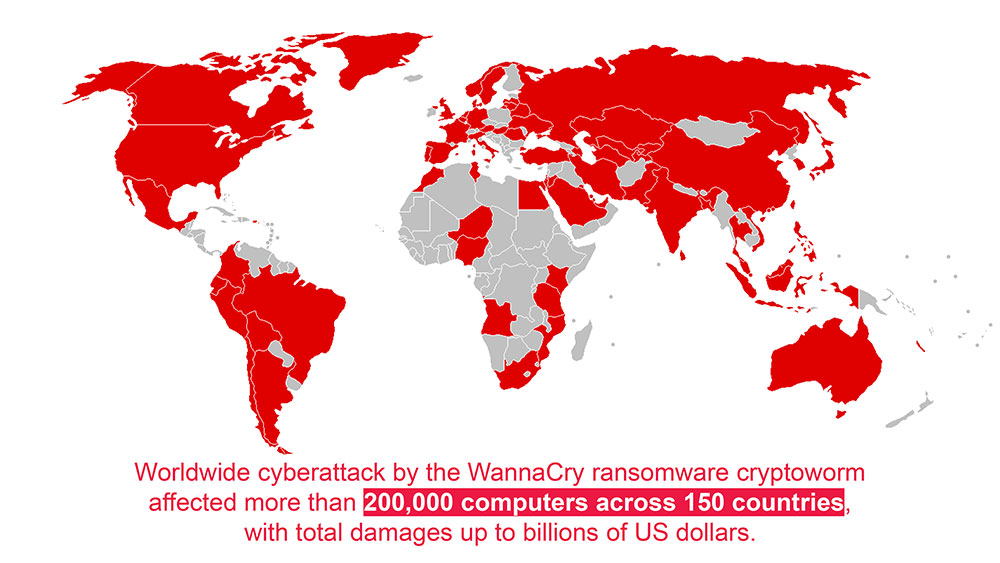

AIG is also the leading cyber insurer in Malaysia, and anticipates that the local demand for cyber-protection against data breaches, identity theft and malware will rise. In Greater China last year, AIG saw an increase of 87 per cent in cyber submissions following the WannaCry cyberattack – more than double the 38 per cent increase in cyber submissions that AIG observed globally.

Protection for SMEs

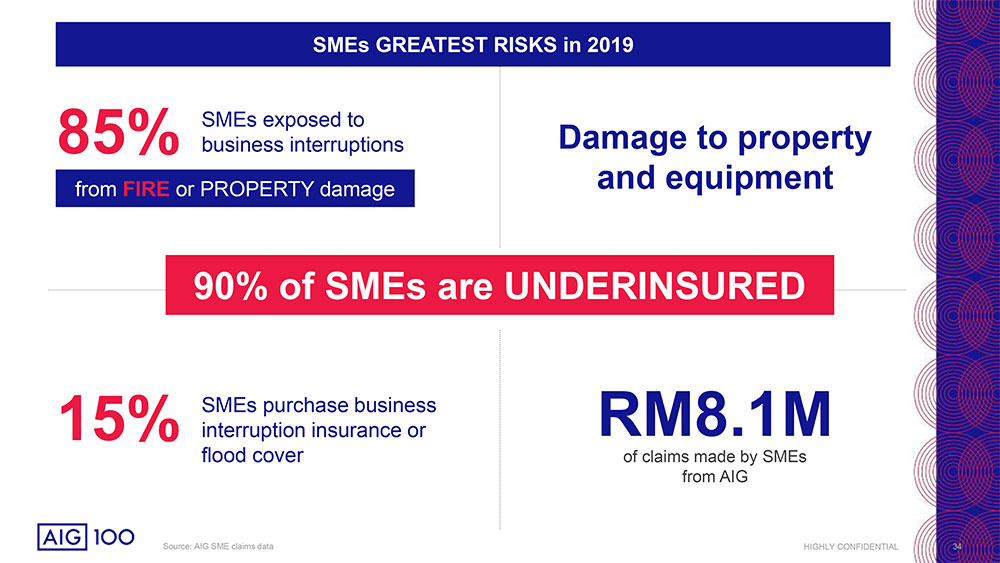

According to the company’s claims data, fire accounted for most SME claims in the last three years, and claims count and claim amount for fire losses also increased year-on-year in 2017. Despite the increase, only close to 15 per cent chose to purchase business interruption insurance. Similarly, only 15 per cent have purchased flood cover even though heavy downpour and unpredictable flooding has increase business risks for SMEs.

Greater Risk Due To More Accessible Travel

Globalised travel and unpredictable weather exposes travellers to new risks such as natural disasters and terrorism. AIG has introduced a comprehensive travel insurance, TravelGuard and provides 24/7 worldwide travel assistance with AIG Travel Asia Pacific. The first-of-its-kind global assistance service has a network of eight service centres worldwide and multilingual staff ready to assist travellers with anything from baggage delay to medical emergencies and evacuations.

Want to be a better driver? Click here for 5 driving tips to help you be better!

Learn to be a better driver with BMW’s Driver Training Programme!

Think of Carsome when it’s time to sell your car!