Did you just get your first job? If not, are you looking to get a car? Do you need one?

These questions are easy and straightforward, but unfortunately the cost involved in getting a car isn’t. This was the discussion at the recent roundtable with Bosch Automotive Aftermarket, Allianz Insurance and RinggitPlus.

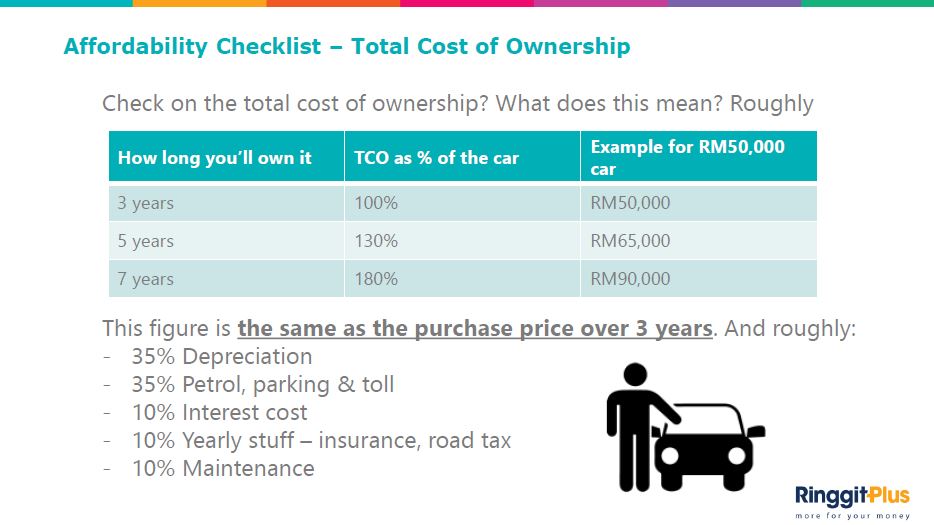

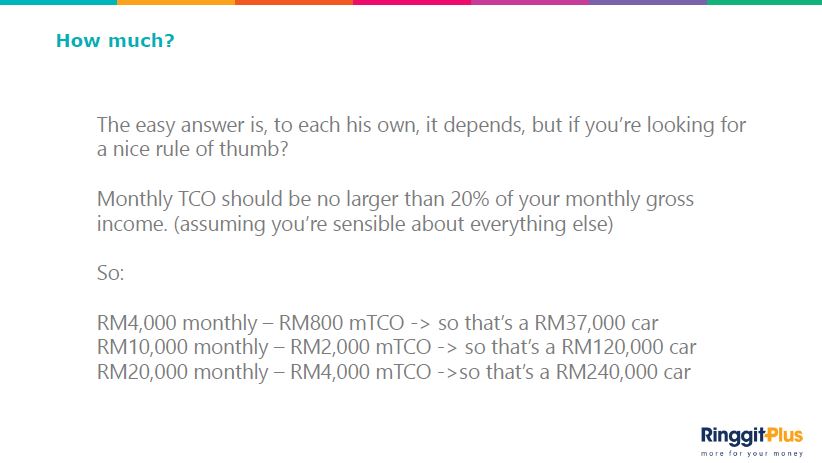

The session was to discuss and provide insights into financial planning, vehicle protection and car maintenance factors; cost benefits when purchasing a car. But does affording a car involve just the downpayment and instalments? According to Hann Liew, Founder of RinggitPlus, the individual must first ask if getting a car is a need; and if they can afford it.

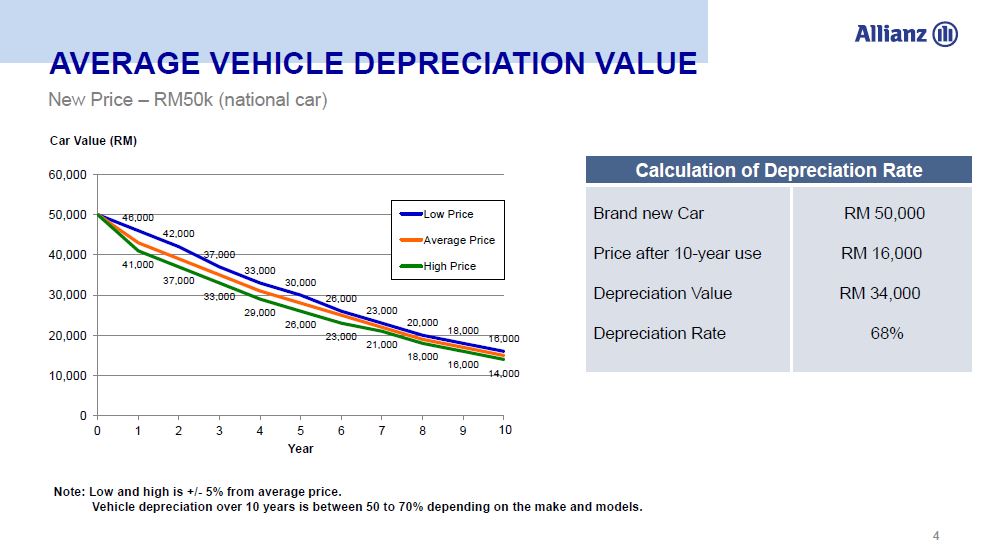

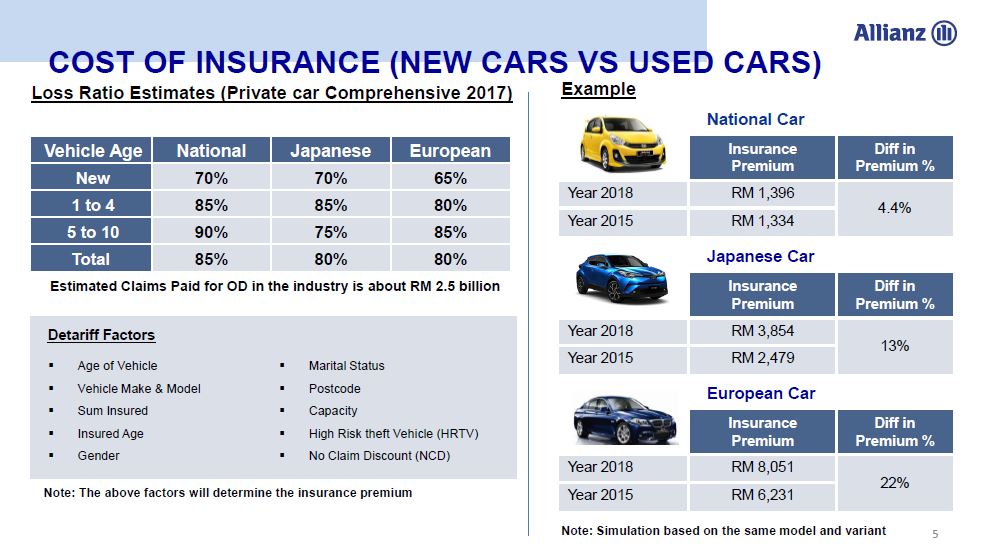

So should you then look at a used car instead of purchasing new? Either or, your vehicle will need insurance. When looking at an insurance perspective, Sazali from Allianz stated that used cars usually have a lower insurance premium compared to new cars.

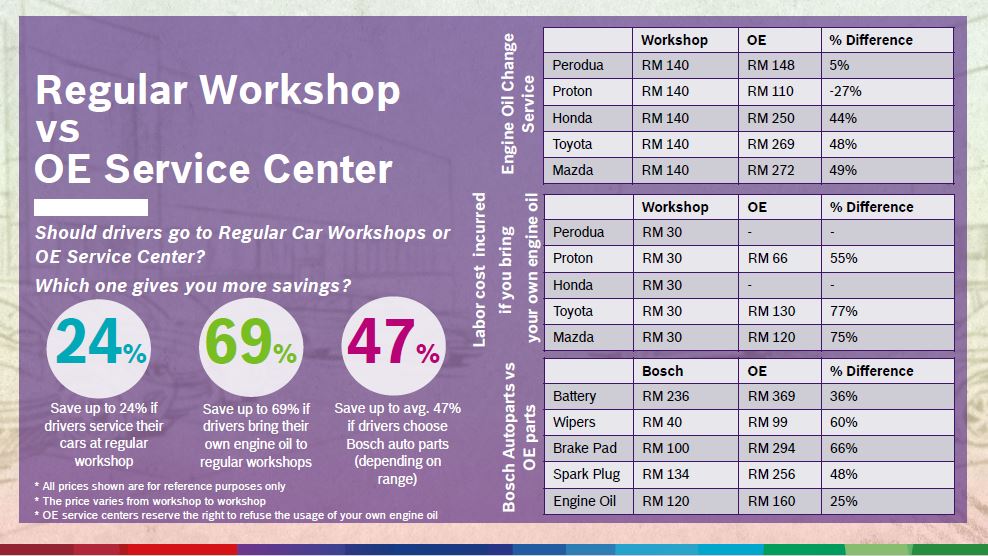

What about maintenance? This cost factor is also occasionally ignored, but it doesn’t have to be a burden. “If you’d like to better optimise your car maintenance budget, either DIY in the upkeep of some auto parts such as changing your own wiper blades or opt for reputable brands for auto spare parts as they can lower your car maintenance cost by 25 to 50 per cent”, said Go Boon Wah, Marketing Manager, Bosch Automotive Aftermarket Malaysia.

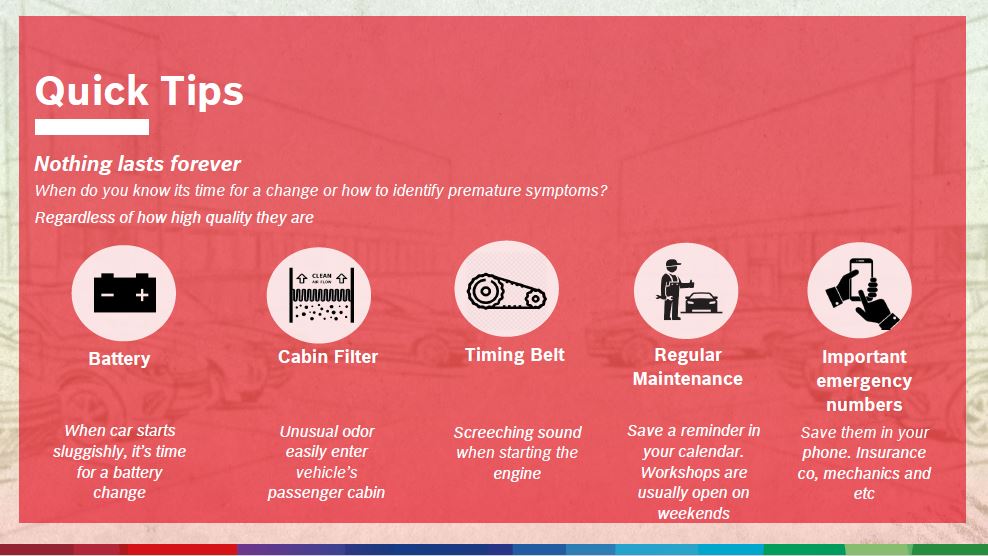

Optimising the car maintenance budget are points that Bosch has put together. These are:

- Understanding your car (Eg. If car starts sluggishly, it could be time for a battery change)

- Work with trusted workshops (Based on reputation and word of mouth recommendations)

- Regular Maintenance (Faulty parts will cause other parts to work harder, leading to further breakdown)

- DIY (Purchase wipers online and fix it yourself to save on labour cost)

- Choose quality-assured auto parts (Save average 47% if you purchase Bosch quality auto parts)

So the takeaway? Owning a car in Malaysia is no walk in the park. It takes commitment in knowing the long term costs involved, the incurred depreciation, insurance, and maintenance savings that you will gain in the long run. Remember that it is always important to be an informed individual when it comes to proper car ownership.

Click here if you want to know the breakdown of how much it really costs to own a car in Malaysia!

New to car loans? Click here for an infographic of a beginners guide to car loans!

Sell your car through Carsome and connect yourself to over 900 dealers nationwide! It is fast, fair and free!